A founder recently asked me"Why are we wasting time building the wrong things?"

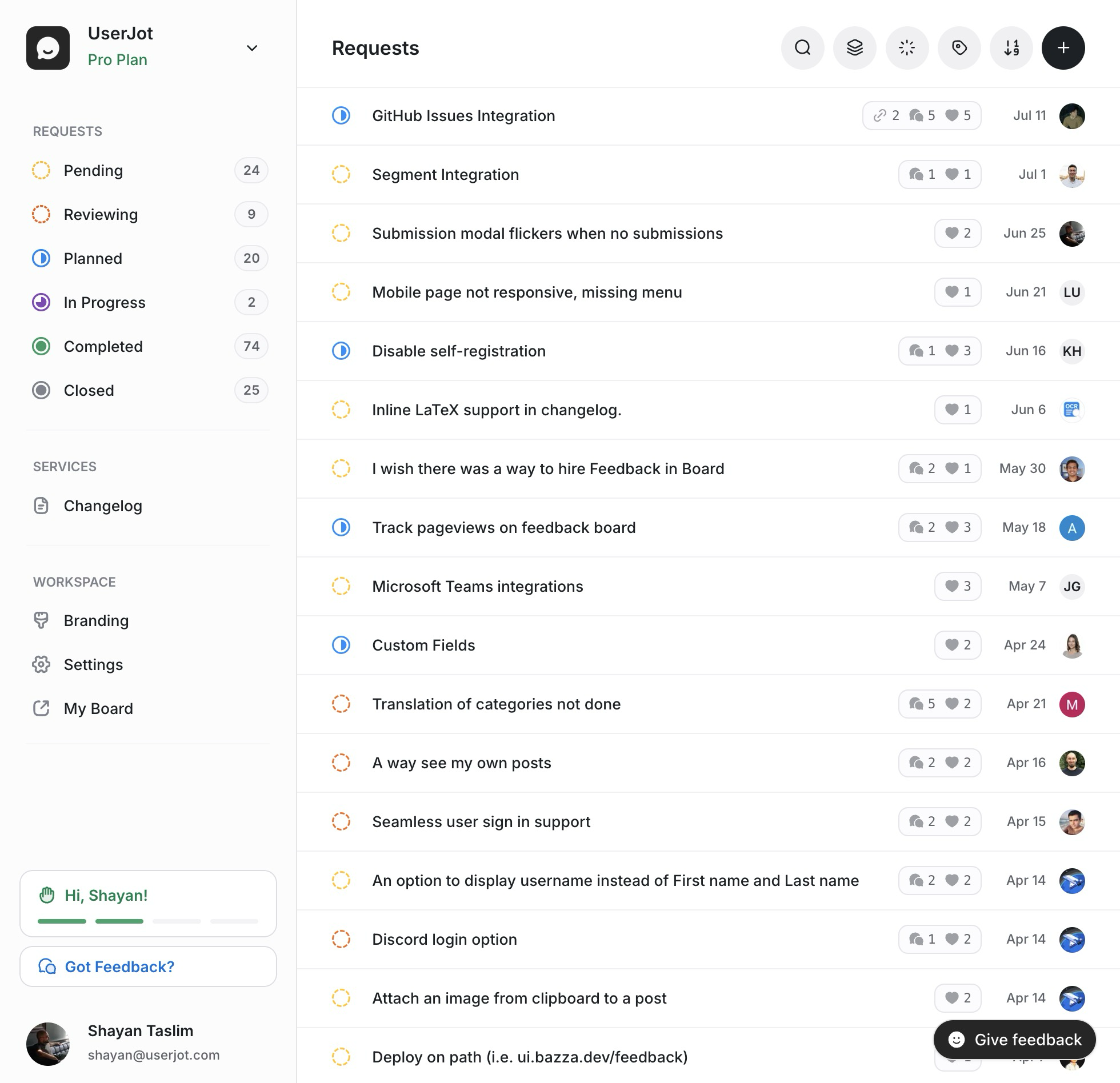

You're drowning in feedback scattered across Slack, emails, and support tickets. UserJot creates a central place where users submit, vote, and discuss ideas so you always know what to build next.

No credit card required. No setup needed.

She then continued"Every day, it's the same story with feedback..."

Sarah • 2 minutes ago

So I asked what if you could...build exactly what users actually want?

UserJot gives feedback a home where users vote, discuss, and help shape your product. Watch as popular requests bubble up and turn into features users love.

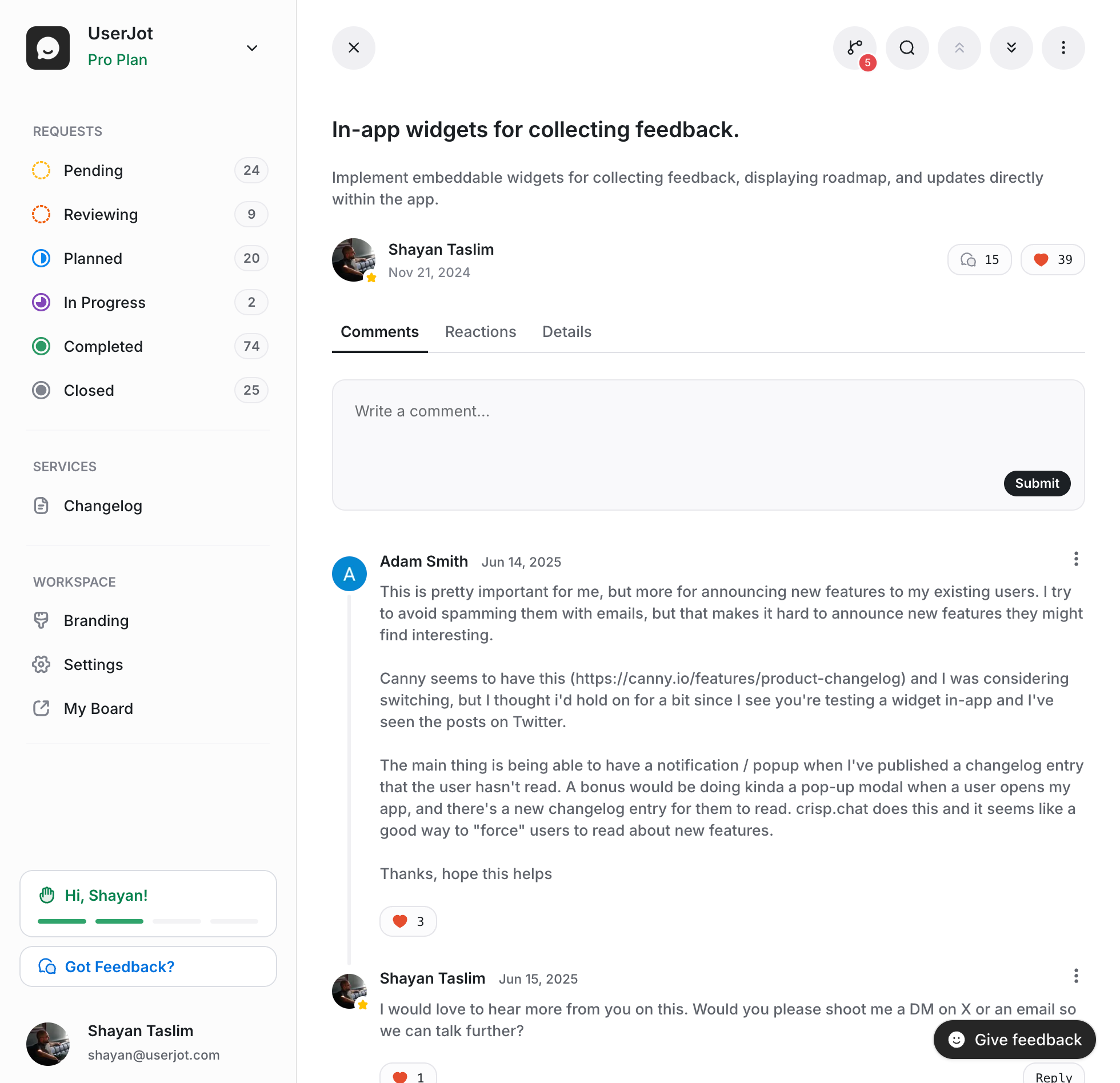

Understand the real problem behind every request

Votes show what's popular, discussions reveal why it matters. See who needs each feature, understand their workflows, and build solutions that actually solve problems. Ship with confidence, not guesswork.

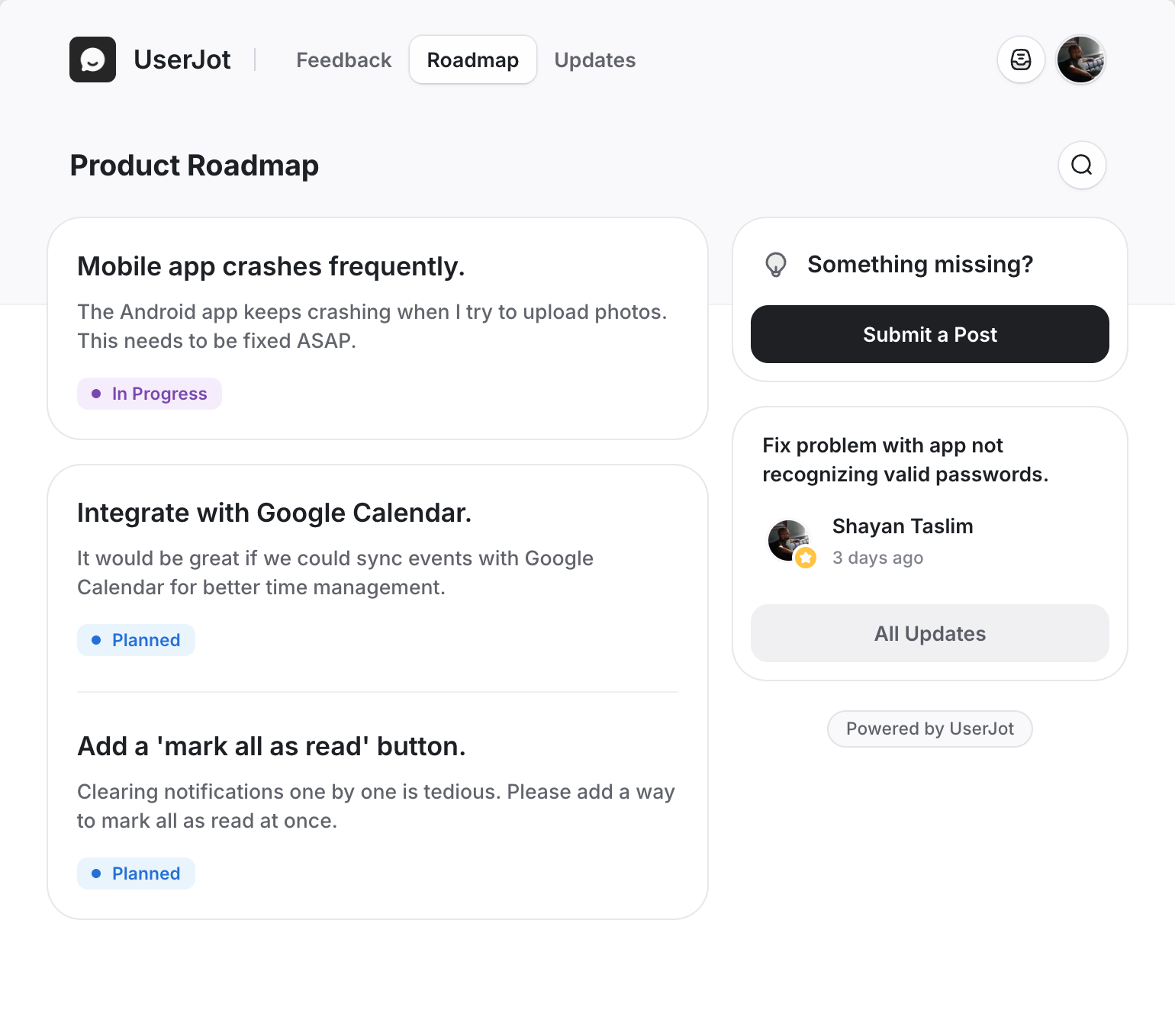

Turn your roadmap into a reason to stay

A public roadmap shows users their requested features are actually being built. They see timelines, follow progress, and get excited instead of frustrated. No more "when will this ship?" emails.

Ship features users requested and tell them about it

The best moment in product building? Telling someone "You asked for this, and we built it". Beautiful changelogs showcase every release while automatically notifying requesters. Turn customers into advocates.

Build Trust

Show users you're listening to their feedback and actively working on their requests.

Engage Users

Keep the conversation going with automatic update notifications.

Control Access

Choose what to share and when to share it with your users.

Stay Organized

Beautiful changelogs that automatically sync with your roadmap.

Start for free, upgrade when you're ready

Start collecting feedback today. Everything you need to build better products is free. Upgrade only for advanced features as you scale.

Free

$0per month

Free, forever.

What's included

Unlimited Posts

Unlimited Users

3 Admin Roles

2 Feedback Boards

Roadmap

Changelog

What's included

Unlimited Posts

Unlimited Users

3 Admin Roles

2 Feedback Boards

Roadmap

Changelog

Starter

$29per month

For small teams.

What's included

Custom Domain

Custom Branding

Guest Posting

5 Feedback Boards

Private Boards

One Integration

What's included

Custom Domain

Custom Branding

Guest Posting

5 Feedback Boards

Private Boards

One Integration

Professional

$59per month

For growing teams.

What's included

Unlimited Boards

Advanced Search

Guest Posting

Single Sign-On

Unlimited Integrations

Unlimited Admin Roles

What's included

Unlimited Boards

Advanced Search

Guest Posting

Single Sign-On

Unlimited Integrations

Unlimited Admin Roles

How much would 10% lower churn save you? Calculate your savings

Your users have a vision. Help them build it.

When someone shares an idea, they believe in what you're building. When you truly listen, you don't just build products. You build relationships. That's the difference that matters.

no credit card required. no setup headaches.

Frequently asked questions

You can start collecting user feedback immediately after signing up. Our feedback management software requires no complicated setup.

Yes, UserJot offers extensive customization options to match your brand and improve your customer experience management.

UserJot's smart grouping and voting features help you easily prioritize user feedback, ensuring your product team always knows what to build next.

UserJot helps you prioritize user feedback by allowing users to vote on feature requests. You can quickly see which ideas have the most support, making it easy for your product team to decide what to build next.

Yes, UserJot helps reduce customer churn by showing your users that you value their input. By collecting user feedback, sharing a public roadmap, and posting product changelogs, you keep users engaged and demonstrate that you listen to their ideas.

Absolutely. UserJot is specifically designed as a customer feedback tool for SaaS companies. It helps SaaS product teams collect feedback, prioritize feature requests, and manage product roadmaps effectively.

Yes, UserJot includes built-in product roadmap software. Your roadmap automatically updates based on the status of user feedback, keeping your users informed about upcoming features and improvements.

Yes, UserJot provides easy-to-use feedback tracking features. You can organize, categorize, and track all user feedback in one place, ensuring nothing important gets lost.

Yes, UserJot makes it easy to create and share a product changelog. Every time you complete a feature request, you can automatically notify users through beautifully formatted changelog entries.

UserJot improves customer experience management by providing a central place for users to share feedback, see your roadmap, and follow product updates. This transparency keeps users engaged and satisfied with your product.

Yes. UserJot allows guest feedback submissions, making it easy for anonymous or first-time visitors to share valuable insights without creating an account.

Yes, UserJot offers extensive customization options, including custom branding, custom domains, and white-labeling. This helps you maintain a consistent brand experience for your users.

UserJot integrates seamlessly with many popular product management tools. You can connect UserJot with your existing workflow to easily manage user feedback, prioritize feature requests, and keep your team aligned.